Political Instability: Hope for the best. Plan for the worst.

One thing is clear: the governmental regulatory and trade policy changes headed our way will have both intended and unintended consequences for U.S. manufacturers. While no one can anticipate exactly what the fall out will be from the proposed changes, operations leaders at all levels have a responsibility to put their companies in a position to capitalize quickly on opportunities that arise, while mitigating the damage of any potentially negative developments.

Despite uncertainty and political instability, manufactures must take action now.

How, exactly, are these leaders going about the tough task of preparing for the unknown? Our recent Supply Chain Readiness Study, completed with Aberdeen Group, highlights some of the key steps manufacturers are taking right now.

Deliberately develop the right supply chain and manufacturing capabilities.

Solid operations practices support an organization’s growth and profitability objectives and can help businesses better respond to changing conditions. In other words, the stronger a business is operationally, the better it can hold its own even when policy changes are not particularly favorable.

To prepare for trade policy and regulatory changes happening at home and around the world, companies need to focus on their supply chain capabilities for managing material flows, orders, and finances. Specifically, they need strong sales and operational (S&OP) processes. These capabilities allow managers to understand what’s influencing current financial results and predict future performance so they can better align supply and demand, even as key variables change. Our research shows that most manufactures feel their S&OP processes are ready to respond, which will serve them well regardless of what, ultimately, is handed down from Washington in the coming months and years.

Rationalize your supply base more often.

Supplier rationalization used to be primarily about reducing the number of suppliers based on price and delivery performance. Today, it’s a bit more complicated. Companies need to build supplier networks that align with both current and future business needs, and they must factor in risk, responsiveness and flexibility, in addition to prices. Sometimes, companies may find that they need more suppliers, not fewer.

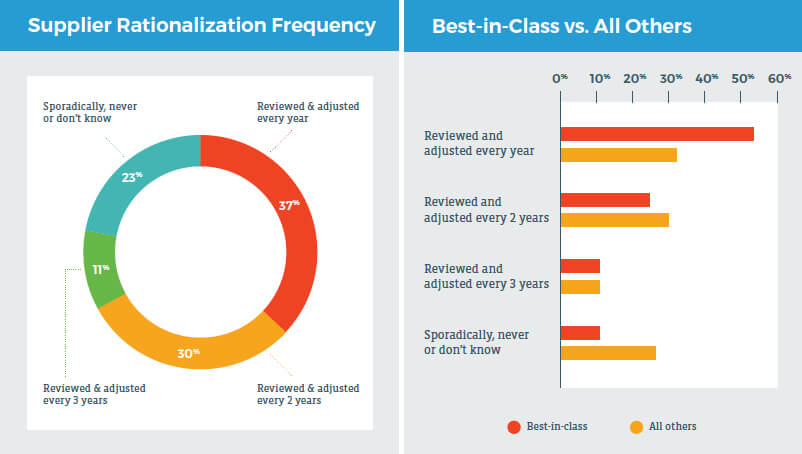

With political instability and an uncertain future on the horizon, companies are well-advised to engage in supplier rationalization on a frequent basis. Best-in-class manufacturers are much more likely than their peers to review and re-adjust their supply chain annually. However, the majority of manufacturers engage in supplier rationalization just once every two years, or even less often. This could put those businesses as risk for missed opportunities and unforeseen risk exposure.

Make it everyone’s job to anticipate and manage the impact.

Operations managers at all levels—in procurement and purchasing, manufacturing, supply chain and logistics and human resources—often have a better ground-level understanding of how work gets done then senior company leaders do. After all, they are in the trenches every day. These leaders need to understand potential changes, play a role in assessing their impact, and help with developing viable response plans in collaboration with customers and suppliers. Operations leaders can help companies ask the right questions, determine strategies for making their supply chains less vulnerable to forthcoming changes, and ensuring they can respond quickly when tax, regulatory and policy changes do go into effect.

See the complete findings from our latest supply chain research report or join our webinar.

Proactively prepare for political instability. Our new Supply Chain Readiness Research report provides details on the potential impact of impending governmental trade policy, tax reform, and regulatory changes along with insights on the readiness of manufacturing companies to respond to such changes. Download the benchmarking research report now.